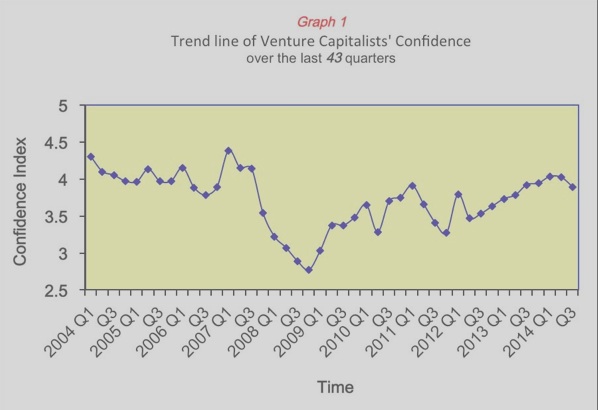

Mark v. Cannice writes: The Silicon Valley Venture Capitalist Confidence Index® (Bloomberg ticker symbol: SVVCCI) is basedon a recurring quarterly survey of San Francisco Bay Area/Silicon Valley venture capitalists. The Indexmeasures and reports the opinions of professional venture capitalists on their estimations of the highgrowthventure entrepreneurial environment in the San Francisco Bay Area over the next 6 – 18 months.1The Silicon Valley Venture Capitalist Confidence Index® for the third quarter of 2014, based on aSeptember 2014 survey of 33 San Francisco Bay Area venture capitalists, registered 3.89 on a 5 pointscale (with 5 indicating high confidence and 1 indicating low confidence). This quarter’s indexmeasurement fell from the previous quarter’s index reading of 4.02.

In summary, confidence declined in the third quarter of 2014, ending an upward trend in sentiment over the previous two years. Worries over inflated valuations and their eventual impact on the venture business model, along with concern on the macro environment, drove the decline in confidence. However, a still strong if moderating exit market for venture-backed businesses, healthy levels of investment and fundraising, rampant disruptive innovation, and the ever present belief in the determination of Silicon Valley entrepreneurs kept sentiment at a relatively high level. Recent public market volatility, though, may slow the exit environment in the near term, with a resulting drag on other aspects of the venture business model. Whether the deceleration in public and private markets acts as a moderating force against over exuberance or is a signal of a longer-term slowdown in the entrepreneurial and broader economic environment remains to be seen. Venture Capital Confidence