There are pros and cons to the French high-frequency tax, but some variation may be desirable. A properly-structured high-frequency tax would cap the value of speed—to end the race to spend billions to save milliseconds. It also would charge traders to tease information out of investors. But it should exempt participants who contribute beneficially to the markets–like market makers that are registered with an appropriate national securities exchange. Taxing may be easier to effect in the US than getting the SEC to act.

W-T-W.org

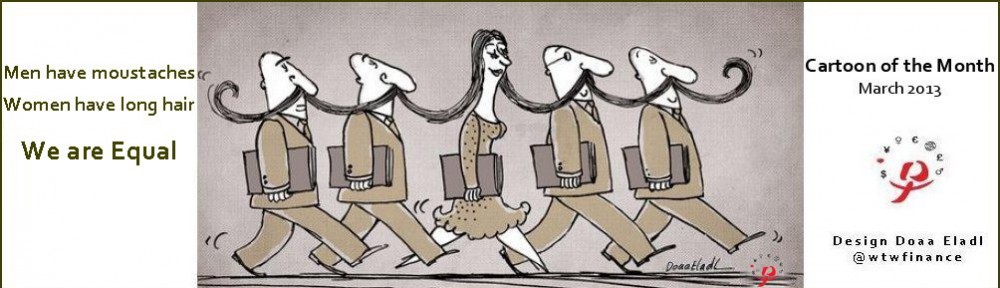

Women and Finance