We continue to watch the US Federal Reserve move into questionable territory.

The Federal Reserve “might legitimately consider” using helicopter money in an “all-out” effort to rescue the U.S. economy from a severe downturn, Fed Chairwoman Janet Yellen said.

“It is something one might legitimately consider. I would see this as a very abnormal, extreme situation,” Yellen said.

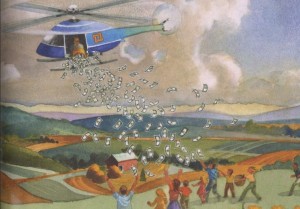

Helicopter money, a policy that has been taboo for fifty years, calls for a central bank to print money and give it to people, most likely in cooperation with fiscal policy like a tax cut or to fund spending.

Some academics have been pressing the case for using the policy in small doses in the face of weak global demand.

The imagery of dropping money from the sky was the work of Milton Friedman.

Former U.K. bank regulator Adair Turner, a leading advocate for use of helicopter money, said that the Fed would likely struggle to raise rates in coming months and should think about the policy if necessary.

Yellen’s views are similar to former Fed chief Ben Bernanke, who argued in a recent blog post that helicopter money should not be ruled out “under certain extreme circumstances —sharply deficient aggregate demand, exhausted monetary policy, and unwillingness of the legislature to use debt-financed fiscal policies.”

Bernanke earned the nickname “Helicopter Ben” for citing Friedman’s idea as a possible fix for Japan’s economic doldrums.

Fiscal policy and monetary policy would hopefully not be working at cross-purposes with severe downside risks, Yellen said.

“Whether or not, in such extreme circumstances there might be a case for, let’s say, close coordination where the central bank playing a role in financing fiscal policy” is being debated by academics, she noted.