Jonathan Browning writes: China’s listed firms are in the midst of their biggest-ever overseas shopping spree, taking advantage of a wide and attractive valuation gap between domestic shares and foreign assets.

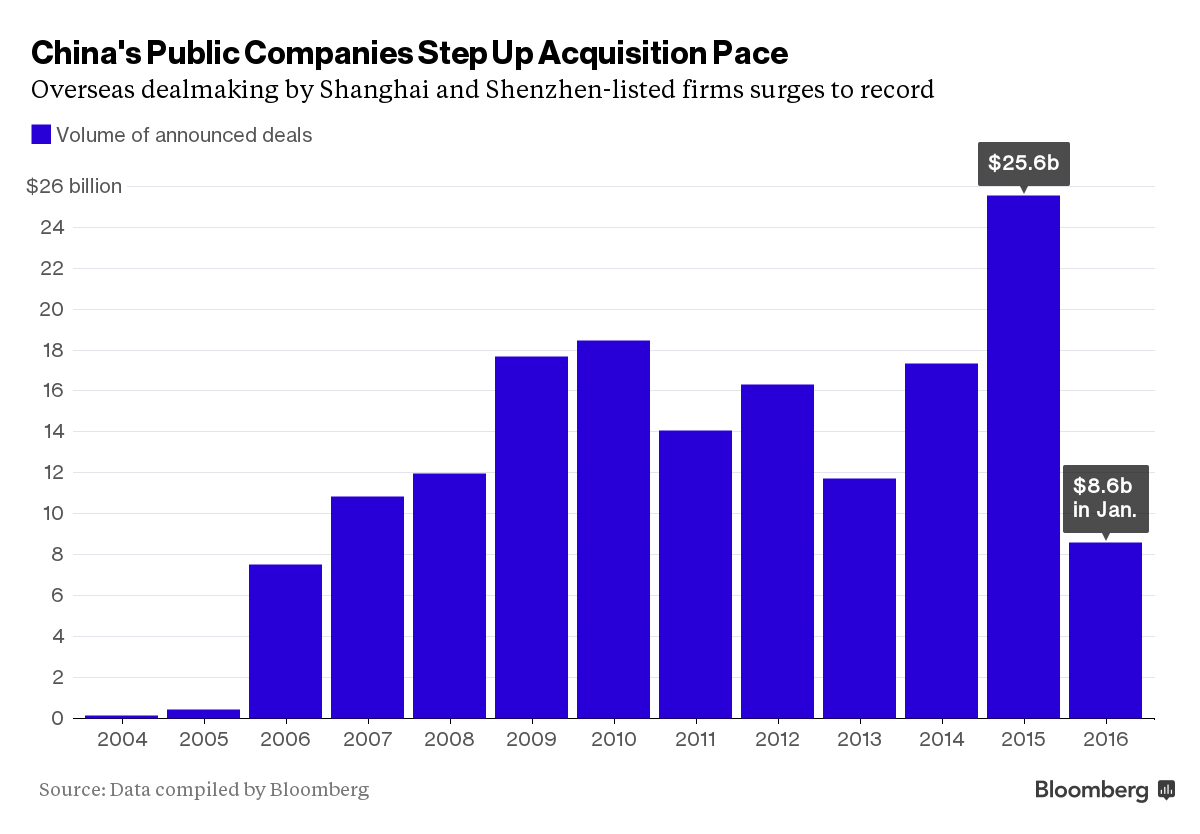

Haier Group Corp. said last week it will use its publicly-traded arm in Shanghai to acquire General Electric Co.’s home-appliance business for $5.4 billion, pushing outbound deals from the nation’s listed companies to $8.6 billion so far this year. The Chinese stock market rout this month hasn’t slowed the volume of foreign acquisitions, which has already reached one-third of last year’s record tally, according to data compiled by Bloomberg.

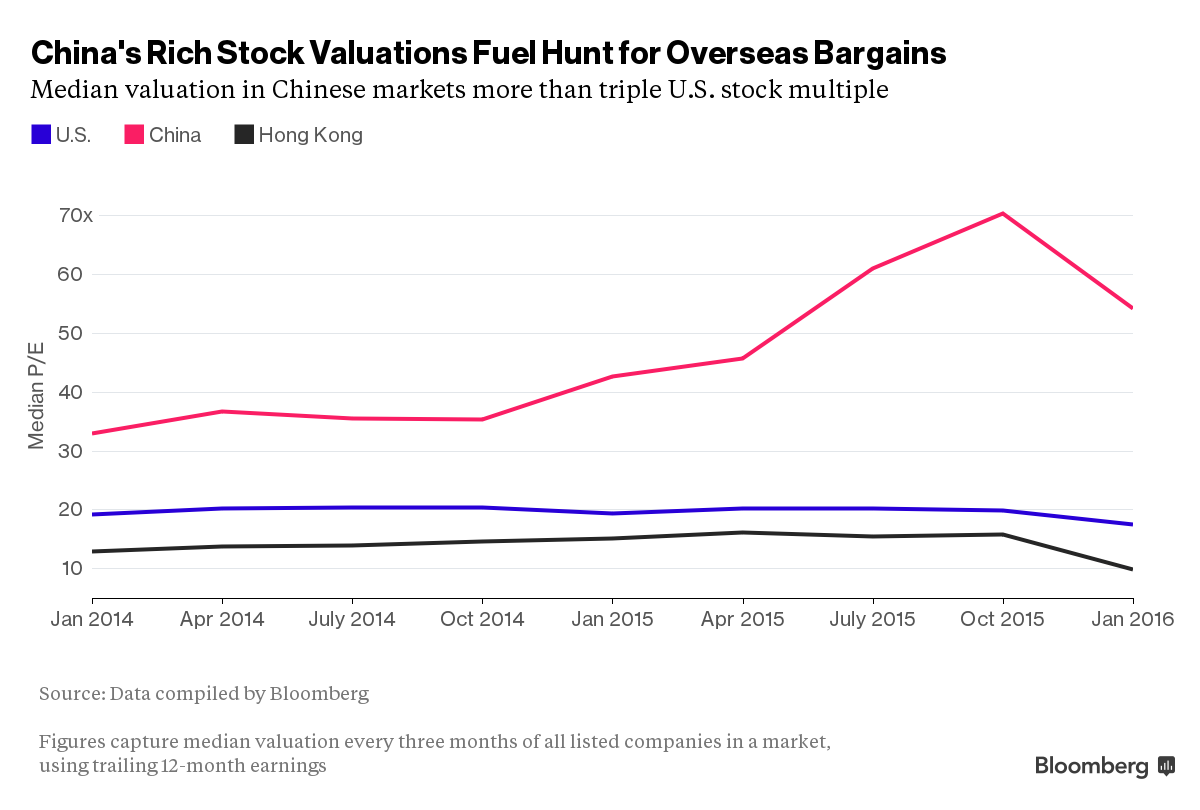

Pricey stocks leave ample room for Chinese companies to boost returns by buying more profitable assets overseas for less. With domestic firms valued at more than three times the level in the U.S., what was previously a select group of China’s outbound acquirers is set to widen, helping the nation continue its record dealmaking run.

Rich Valuations

Shanghai and Shenzhen-traded firms announced $25.6 billion of overseas acquisitions and investments last year, up 48 percent from 2014, Bloomberg-compiled data show. Top dealmakers, including Tsinghua University’s investment arm and the owner of China’s fourth-largest airline, are using their listed units to make deals. Smaller firms with less of a track record are also pursuing acquisitions overseas, often using their own stock to fund the purchases.

Shanghai-listed BTG Hotels (Group) Co. last month announced a $1.8 billion agreement to acquire budget lodging chain Homeinns Hotel Group. BTG Hotels, backed by the Beijing city government, is seeking Chinese regulatory approval for a 3.9 billion yuan ($593 million) equity offering to fund part of the purchase.

Including debt, U.S.-traded Homeinns was valued at 22.6 times earnings before interest and taxes, while BTG Hotels trades at 45.2, according to data compiled by Bloomberg. After announcing the transaction Dec. 24, BTG Hotels surged more than 75 percent over the next six trading days.

Shandong Delisi agreed to buy 45 percent of Bindaree Beef Pty for A$140 million ($97 million), valuing the Australian meat producer at 24 times EBIT, data compiled by Bloomberg show. The Chinese company trades in Shenzhen at a multiple of 235 times.

“Just like Chinese consumers who shop around the world, Chinese companies are looking overseas for nice bargains,” said Ken Chen, a Shanghai-based analyst at KGI Securities Co. “It resembles what Japanese companies did in the 1980s on the back of the country’s industrialization and a strong yen.”

Bubbles in China’s housing and stock markets leave companies with limited investment options domestically, and the government has encouraged enterprises to “go out” and help promote the yuan’s internationalization, Chen said. The yuan became part of the International Monetary Fund’s basket of reserve currencies in December.

“Chinese like to cut corners and overtake,” said Brian Lin, who manages NT$9.2 billion ($272 million) at Capital Investment Trust Corp. in Taipei. “They like to upgrade themselves fast by buying assets, techniques and patents.”

While A-share firms sometimes struggle to gain regulatory approval for share sales and are required to make early disclosures that may spike deals, they are finding workarounds, UBS’s Lo said. Companies can take out bridge loans that are later repaid through a share placement, or the controlling shareholder can make an acquisition first before a listed unit issues stock to take it over, he said.

The China Securities Regulatory Commission sped up approval for equity offerings in December after five months of slackness following a stock rout. Companies completed $21.9 billion of additional share sales in December, nearly triple the November value. This month’s stock rout has not slowed things down with $14 billion of deals done in three weeks.

In addition, Chinese companies and private-equity funds are eyeing U.S.-listed stocks for arbitrage opportunities. At least 40 U.S.-listed Chinese companies announced buyout bids last year totaling a record $38 billion. Qihoo 360 Technology Co., a developer of mobile-phone security software, received a $9.3 billion going-private offer last month, the biggest of its kind in 2015.

China pulled out all the stops in the third quarter to try to stem a stock rout and prevent the bubble from bursting, setting up a bailout fund of as much as 3 trillion yuan to prop up share prices, people with knowledge of the matter said in July. The benchmark Shanghai Composite Index, which rose 1.3 percent Friday, is still down 44 percent from its June high.