Russian oil keeps pumping in Siberia, despite crash in oil prices.

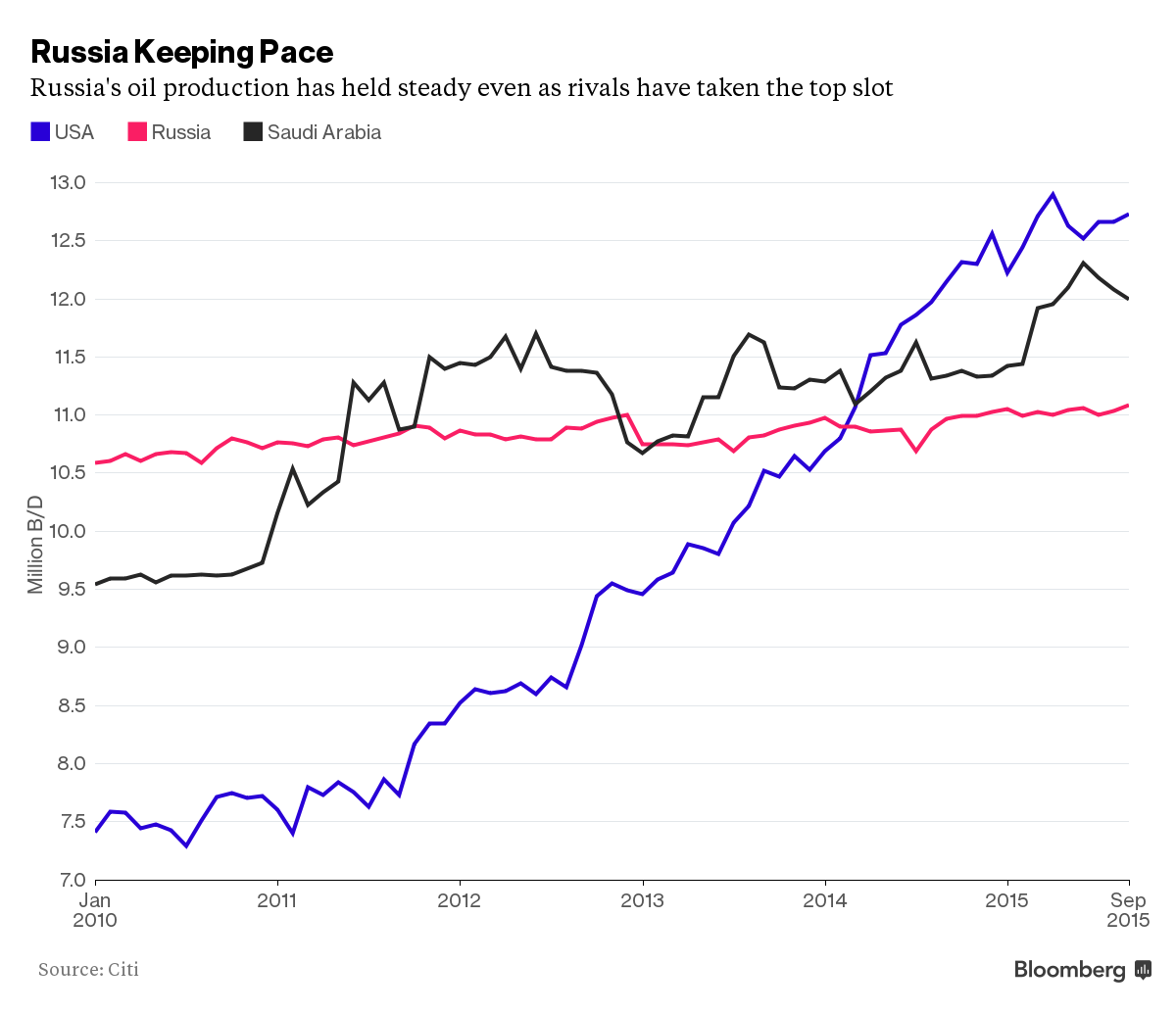

Stephen Bierman writes: In the fight for market share among the world’s oil producers this year, Russia wasn’t supposed to be a contender.

But the world’s No. 3 producer has been pumping at the fastest pace since the collapse of the Soviet Union, adding to the flood on an already-swamped market and helping push prices to the lowest levels since 2009.

Russia’s unexpected oil bounty this year is the result not of a new Kremlin campaign but of dozens of modest productivity improvements across the sprawling sector. Even pressured by plunging prices, as well as U.S. and European Union sanctions that cut access to much foreign financing and technology, Russian companies have managed to squeeze more crude out of some of the country’s oldest fields. They have also brought new projects on line, offsetting steady declines in its core producing region of West Siberia.

One side effect of falling oil prices — the 52 percent plunge in the ruble over the last two years — has helped Russian oil producers, chopping their costs in dollar terms since between 80 and 90 percent of their spending comes in rubles.

Relatively high taxes on oil have actually sheltered the industry from much of the impact of the drop in prices. Bashneft and other Russian companies working fields in the Volga River basin — some of the first to be discovered in Russia early in the last century — are benefiting from Soviet inefficiency.

Custom-designed pumps — made locally and thus not affected by sanctions — help draw oil out of narrow holes, he added. Every month, the company ranks potential drilling and other projects by the minimum oil price needed to make them profitable. Only the above-water ones make the grade, a kind of flexibility and discipline typically associated with western companies.

Across the industry, companies have boosted production drilling to increase output. While the country’s biggest west Siberian fields are showing declines, smaller new projects have more than offset them this year.

Gainers include Irkutsk Oil Co. in Siberia and Exxon Mobil Corp.-led Sakhalin-1 in the Sea of Okhotsk.

In the Arctic, Novatek started production at the Yarudeyskoye oil field this month. The field will “rapidly reach” planned output of about 70,000 barrels a day, the company said early this month.

Though only about 0.7 percent of total Russian oil output, that gain is likely to be enough to keep the record pace going, said Alexander Nazarov, an oil and gas analyst at Gazprombank.