Raymond Colitt and Anne Edgerton write: Nelson Barbosa could, of course, turn out to be the man who fixes Brazil’s finances, tames soaring inflation and revives the sinking economy, but investors sure aren’t betting on it.

He replaces Levy, the market’s golden boy, with his University of Chicago-training, asset-manager experience and reputation as a fierce budget cutter. Barbosa, while generally respected by analysts for his technocratic skills, isn’t seen as being quite as tight-fisted on spending, a perception he only reinforced when suggesting that he was amenable to granting subsidies to some industries.

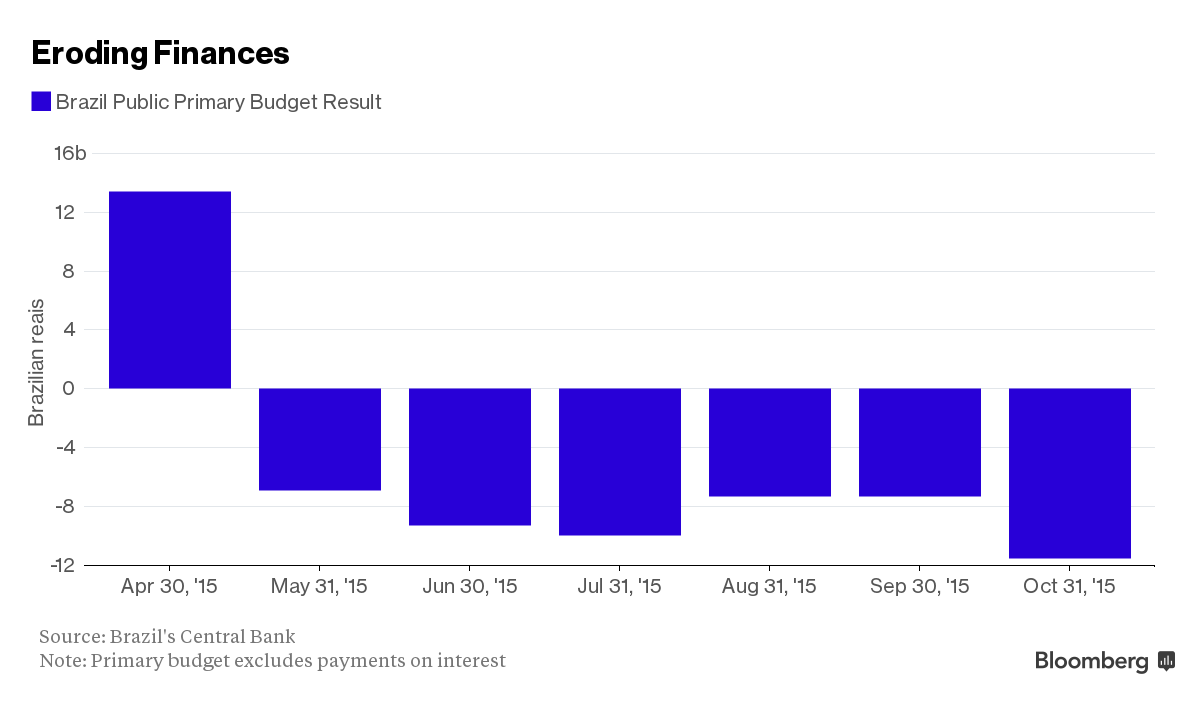

Levy struggled almost from the outset, though, to reverse the widening budget gap. With legislators focused on the corruption scandal — which began at state-run oil giant Petrobras and has landed many executives and politicians in jail — little attention was paid to his pleas to cut spending. His relentless push in Congress to curtail labor and pension benefits earned him scorn from many members of the ruling Workers’ Party, which traditionally championed a robust social safety net.

Even some business leaders started to express concern that Levy’s struggles to shore up fiscal accounts were blinding him to the need to stimulate growth. As the country’s finances worsened and the economy slipped deeper into recession, markets sank month after month. The currency is down 33 percent against the dollar this year. Prices on the government’s 10-year bonds have dropped to 82 cents on the dollar from 99 cents when Levy took office back in January. The yield has climbed to almost 7 percent.

The task of negotiating with Congress now falls to Barbosa, a 46-year-old economist who studied at the New School for Social Research in New York and started his career as a civil servant at the central bank in the mid-1990s.

The strength of the minister’s ties may get tested quickly. Barbosa has said he’d try to push through plans to simplify taxes and cap pension spending. He said in an interview with Estadao newspaper over the weekend he would win approval by May of a tax on banking transactions. Those are proposals that Levy never managed to get Congress to back.