No one can fail to understand this argument after seeing the new film, “The Big Short.”

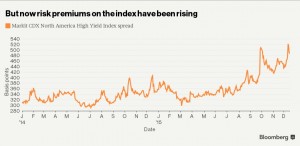

Citigroup analysts led by Anindya Basu point out that spreads on the CDX HY, as the index is known, are currently pricing in an expected loss of 21.2 percent, which translates into something like 22 defaults over the next five years if one assumes zero recovery for investors. That is a pretty big number once you consider that a total of 41 CDX HY constituents have defaulted since the index really began trading in 2005, equating to about 3.72 defaults per year. A big chunk of those defaults (17) occurred in 2009 in the aftermath of the financial crisis.

What to make of it all? Actual recoveries during corporate default cycles tend to be higher than the worst-case scenario of zero percent. In fact, they average somewhere in the 26 percent range, which would imply 29 defaults over the next five years instead of 41.

So what? you might say. The CDX HY includes but one default cycle, and those types of analyses tend to underestimate the peril of tail risk scenarios (hello, subprime crisis). Citi has an answer for that, too. Using spreads from the cash bond market going back to 1991, they forecast the default rate over the next 12 months to be something more like 5 percent to 5.5 percent. (For comparison, the rating agency Moody’s is currently forecasting a 3.77 percent default rate.)

“CDX HY spread levels are pricing in about a 21 percent loss over a five-year period, whereas the highest we have ever seen over a five-year period is 14.2 percent, and that included 2009,” Basu said in an interview. “Of course, the spread level includes a spread risk premium over and above the ‘pure default’ risk. Even from that perspective, we believe the risk being priced in is too much.”

In fact, Citi says “high-yield spreads are currently pricing in a 2008-like market selloff over the next five years.”

All of which raises the question of just what has been pushing spreads up so high. Perhaps more than any other asset class, investing in junk bonds is an emotional one. It takes high levels of confidence to lend to companies with risky balance sheets, and that confidence is prone to evaporating when headlines about bond mutual fund redemptions flash across Bloomberg terminals and Gawker’s front page.

“There are a lot technicals that could be responsible–we have a lot of negative headlines coming through for high yield that is creating anxiety in the markets and pushing investors to hedge themselves using CDX HY protection, which is pushing spreads up,” said Basu. “That isn’t to say that there are no serious concerns, but the question we are asking is, are spreads pricing in too much risk? I believe the answer is yes.”