Daniel Gros writes: Stubbornly low inflation has the European Central Bank worried. But its response – essentially just more quantitative easing – could backfire, exacerbating imbalances and generating serious financial instability.

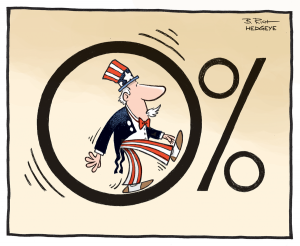

As it stands, the headline consumer price index in the eurozone hovers around zero, and even core inflation remains below 1%.

Instead of rethinking its strategy, the ECB is considering doubling down: buying even more bonds and lowering its benchmark interest rate even further into negative territory.

Easier credit conditions and lower interest rates are supposed to boost growth by stimulating investment and consumption demand. But in the core of the eurozone – countries like Germany and the Netherlands – credit has been plentiful, and interest rates have been close to zero for some time, so there was never much chance that bond purchases would have a significant impact there.

Of course, in the highly indebted peripheral countries, there was room for interest rates to fall and for credit supply to grow – and they have, leading governments and households to increase their spending. While the asymmetrical impact of the ECB’s policy is appropriate in principle, recovery supported by the least solvent economies is not sustainable.

Back in 1986, Hyman Minsky warned about the longer-term dangers to financial stability if “Ponzi” borrowers – those who can service their debt only with new debt – become the main pillar of the economy. A zero-interest-rate environment is of course ideal for such borrowers, because there is nothing to provide an indication of solvency; borrowers can just roll over their debt.

The standard response to Minsky’s concern – that the spenders can’t afford it and the savers aren’t spending – is that monetary policy should focus on ensuring price stability, while macroprudential policy aims to safeguard financial stability by limiting borrowing by highly indebted agents.

After the 2001 recession in the US, although the Federal Reserve kept interest rates low for a protracted period, the corporate sector did not increase its investment. The recovery was ultimately fueled by so-called “subprime” mortgages: home-purchase loans extended to borrowers with lower credit ratings. The result, as we know, was a mega-bubble that triggered the 2008 financial crisis.

In the eurozone’s case, the risk is compounded by the ineffectiveness of its key macroprudential limiting countries’ spending, as lower interest rates give debtor countries leeway to spend more. Public debt as a share of GDP is on the rise in Italy and Spain, even though both countries, with their eurozone partners, have committed to reducing the debt ratio.

In short, monetary policy is perpetuating the disequilibrium between creditor and debtor economies in the eurozone, and macroprudential policy is doing nothing to stop it. When interest rates normalize, this could generate serious financial instability. But – and this is the conundrum – the ECB has few options for stimulating demand among the eurozone’s more solvent agents, and thus supporting a sustainable recovery..

A recovery has already begun in the eurozone. It should be left to run its course. An even more expansionary monetary-policy stance might strengthen the recovery marginally, but at the cost of increasing the eurozone’s already-dangerous imbalances.