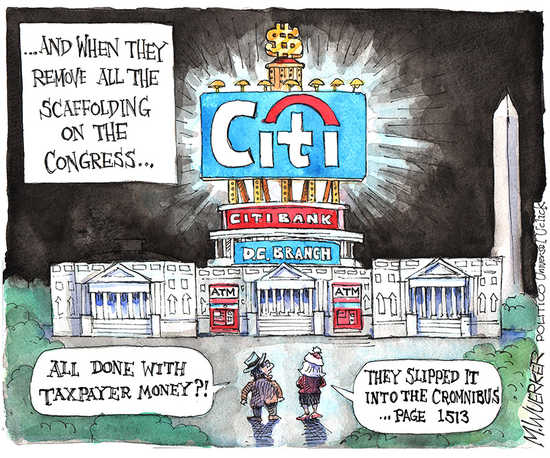

After reportedly finding that partial repeal of Dodd-Frank Act language allows banks to keep trillions in risky trades on the books, U.S. Sen. Elizabeth Warren, D-Mass., called on the Securities and Exchange and Commodity Futures Trading Commissions Monday to implement rules that protect taxpayers and the financial system.

Warren, who joined Maryland Rep. Elijah Cummings in investigating the risks posed to taxpayers following the 2014 partial repeal of the law, also asked the Government Accountability Office to analyze the impact of the modified Dodd-Frank provision.

According to Warren and Cummings’ review, rollback of the section of the law designed to prevent taxpayer bailouts of federally insured banks with risky swaps holdings, now allows banks to keep nearly $10 trillion in swaps trades on their books. The Democrats also found that regulators have failed to analyze the financial and taxpayer risks posed by the repeal.

In a letter to the CFTC and SEC, Warren and Cummings urged the federal agencies to “act quickly to mitigate the risks posed by uncleared swap activities by imposing strong margin requirements for swaps between bank affiliates and other entities under (their) authority.”

Warren and Cummings urged the GAO Comptroller of the total value of swaps U.S. banks originally would’ve been required to “push out” under the provision; an estimate of the total value of swaps U.S. banks will now be required to “push out” under the revised language; and a quantified assessment of the risks implementation of the section would’ve created for U.S. banks.

“The failure to assess the impact on banks and the economy of the repeal of Section 716 raises critical questions about whether federal policymakers are sufficiently attentive to the risk posed by nearly $10 trillion in risky swaps now primary held – and allowed to be traded and held on an ongoing basis – by a handful of the country’s largest FDIC-insured banks,” they wrote. “Understanding this risk is critical as policymakers continue to make decisions about how banks are regulated.”

The 2015 Consolidated and Further Continuing Appropriations Act modified the Dodd-Frank Act section.

Warren and Cummings, who contended that the change was made without debate and after intense lobbying from the financial industry, launched their own investigation into its potential impacts.