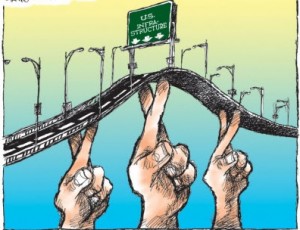

Financing infrastructure is one of the most important challenges faced by governments worldwide.

Thomas Maier writes: Infrastructure – from roads and railways to ports and bridges – and economic growth go together. That is why international financial institutions need to answer appeals for greater investment to help close a $1 trillion global “infrastructure gap.” Our best chance of meeting the world’s growing infrastructure needs is to use multilateral development banks’ unique relationships with governments and the private sector to coordinate our response.

Consider, for example, the progress already being felt in emerging markets. In the past year, the World Bank Group, the Asian Development Bank (ADB), the Inter-American Development Bank (IADB), the African Development Bank, the European Investment Bank, and the European Bank for Reconstruction and Development (EBRD) have all created “project preparation facilities” (PPFs) to improve the quality of project development, while also strengthening the local capacity needed to ensure lasting results.

The various PPFs that have been launched can act as a model for public officials in emerging markets to emulate. The Infrastructure Project Preparation Facility, launched by the EBRD last year, is one example: by using pre-selected “framework consultants,” the facility can accelerate high-quality project preparation for both public-sector projects and public-private partnerships (PPPs). This dual focus is important: private-sector finance is critical, but the public sector still finances some 90% of all infrastructure investment worldwide.

Another important innovation is the online “PPP Knowledge Lab,” launched in June with support from multilateral development banks

Then there is the International Infrastructure Support System (IISS), an online tool directly supported by a number of international financial institutions during its initial start-up phase in 2015 and early 2016.

But any system is only as good as its participants. Responding to the need for more systematic and “standardized” learning, the World Bank Group, supported by the ADB, IADB, EBRD, and the Islamic Development Bank, has commissioned a new Global Certification Program for PPP Professionals. Emerging-market officials will earn accreditation by demonstrating the ability to apply their knowledge practically.

One useful tool in the effort is “Infrascope,”a benchmarking index created by the Economist Intelligence Unit that assesses the capacity of emerging-market countries across the Asia-Pacific region, Latin America, Africa, Eastern Europe, and the former Soviet republics in the Commonwealth of Independent States to deliver sustainable PPPs.

Another is the G-20’s new Global Infrastructure Hub, which shares international good practice and comprehensive data on infrastructure. The Hub has a four-year mandate to focus on five main areas: a network to share information on infrastructure projects and financing; better data on infrastructure investment; the G-20’s recommendations for voluntary lending; government officials’ capacity to share best practices; and a database to match infrastructure projects with potential investors.

It is easy to be daunted by the vast sums needed to close the gap between the infrastructure the developing world has and the infrastructure it needs to support sustainable, inclusive economic growth. But compare the world today with the world a century or more ago, and it is clear that the gap is so much narrower than it was. What will narrow it still more, and so sustain the gains in global growth, will be the spread of infrastructure know-how at the local level in emerging markets. We and our fellow multilateral institutions have a clear duty not just to increase our expertise, but also to share it.