The Economist writes: The ability to make stockmarkets boomerang is usually reserved for central bankers. But on August 24th, hours into a global market rout that had started in Asia and was sweeping its way through Europe and then America, Tim Cook, the boss of Apple, turned his hand to it. “I can tell you that we have continued to experience strong growth for our business in China through July and August,” he wrote in an e-mail to CNBC, a financial-news channel. “I continue to believe that China represents an unprecedented opportunity over the long term.”

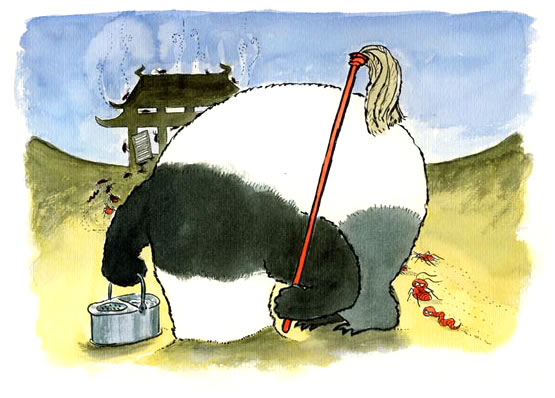

By the time Mr Cook felt it necessary to opine on the state of the world’s second-biggest economy, plenty had started to question its prospects. Following weeks of wobbling, the Shanghai stock exchange had just cratered. A government once credited with near-magical powers to browbeat its economy into growth looked to have misplaced its wand. Suspicions abounded that a decades-long era of superlative—if recently softening—economic expansion might be coming to an end. So the news that Chinese consumers were still in the mood for new iPhones and whizzy watches did more to assuage nerves than reams of official pronouncements from Beijing ever could.

Apple shares reclaimed the $66 billion they had lost; the Dow Jones blue-chip index, having opened down a calamitous 1,000 points, rebounded. But that was a precursor for days of volatility. Many markets around the world crossed the line into “correction” territory, having fallen more than 10% from recent peaks. China’s Market Impacts