The Rocky Road to Globalization

RIchard Haas writes: Is China is best understood as a strong country, with a promising future despite some short-term difficulties, or as a country facing serious structural problems and uncertain long-term prospects. Two very different Chinas can now be glimpsed. But which one will prevail?

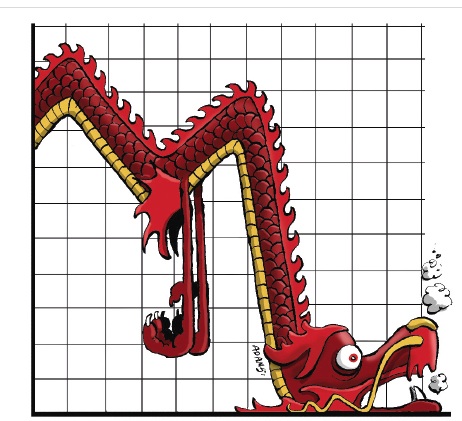

The question of China’s future has become unavoidable. Officially, economic growth has slowed to near 7%; but many believe the real number is below 5%. The slowdown should come as no surprise; all developing economies experience something similar as they grow and mature. Nonetheless, the speed and degree of change have caught the authorities off guard, and have stoked official fears that growth will fall short of the rate needed for the country to modernize as planned.

The government’s alarm at the sharper-than-expected economic slowdown was reflected in the freezing of stock markets in the midst of a dramatic price correction. That move was followed by a surprise devaluation of the renminbi, which suggests that the shift away from export-led growth is not working as hoped.

Corruption is pervasive, and Xi’s campaign remains broadly popular. But the wave of prosecutions that Xi has unleashed is discouraging Chinese officials from making decisions, owing to their fear that they could face criminal charges in the future.

Aside from slowing growth, there is severe environmental damage, one result of decades of rapid, coal-fueled industrialization. Air pollution may be killing 1.6 million Chinese per year.

China’s aging population, an unintended consequence of its draconian one-child policy, poses another threat to long-term prosperity. With the dependency ratio – the proportion of children and pensioners relative to working-age men and women – set to rise rapidly in the coming years, economic growth will remain subdued, while health-care and pension costs will increasingly strain government budgets.

What is increasingly apparent is that China’s leaders want the economic growth that capitalism produces, but without the downturns that come with it. They want the innovation that an open society generates, but without the intellectual freedom that defines it. Something has to give.

A slow-growth China would undermine the global economic recovery. It would be a less-willing partner in tackling global challenges such as climate change. Most dangerous of all, a struggling China could be tempted to turn to foreign adventurism to placate a public frustrated by slower economic growth and an absence of political freedom. Indeed, there are some signs that the authorities are doing just this in the South China Sea. Nationalism could become the primary source of legitimacy for a ruling party that can no longer point to a rapidly rising standard of living.

The US and others will need to push back to ensure that China does not act on such a temptation. But these countries would be equally wise to signal to China that it is welcome to take its place among the world’s leading countries if it acts responsibly and according to the rules set for all.

But the bigger policy choices will be China’s to make. The government will need to find the right balance between government interests and individual rights, between economic growth and environmental stewardship, and between the role of markets and that of the state.