Clark Derrington writes: While both Greece and Puerto Rico have major debts that cannot be repaid due to struggling domestic economies, easy comparison leaves out important details about the debt crisis in Puerto Rico. With a more complete understanding of the situation in Puerto Rico, possible solutions become easier to identify.

The solution to Puerto Rico’s crisis lies in Washinton, DC. . Indeed, Washington is in many ways responsible for creating the underlying economic issues that exacerbated the fiscal emergency.

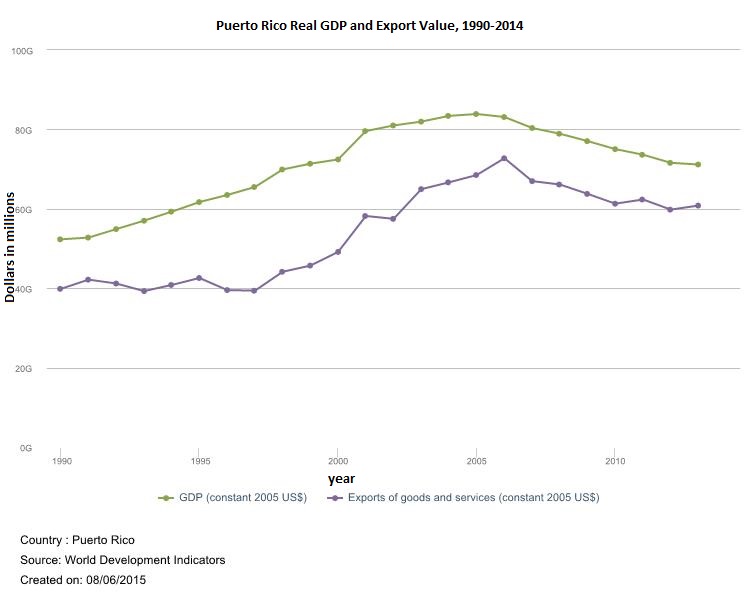

In 2006, Internal Revenue Service Code Section 936, which offered generous advantages to American companies operating in Puerto Rico, finally expired after a gradual phase-out. After the expiration of this tax subsidy, the Puerto Rican economy entered a recessionfrom which it has not yet emerged. As the chart below shows, the decline in real (adjusted for inflation) Gross Domestic Product coincides with a decline in real export value. Export value peaked in 2006, and declined along with the total output of the Puerto Rican economy following the end of the business tax credit.

Manufacturing firms were major beneficiaries of the Section 936 tax credit. Its elimination and the loss of manufacture-for-export directly impacted the Puerto Rican economy and contributed to the severity of the ongoing debt crisis.

The decline in economic output makes it nearly impossible for the territorial government to keep up with ever-growing debt payments. Attempts at fiscal austerity only contribute to the economic decline. Even with an automatic increase in Social Security, Medicaid, and other transfer payments from Washington, local austerity is particularly undesirable in an economy featuring the high levels of government employment seen in Puerto Rico.

Energy

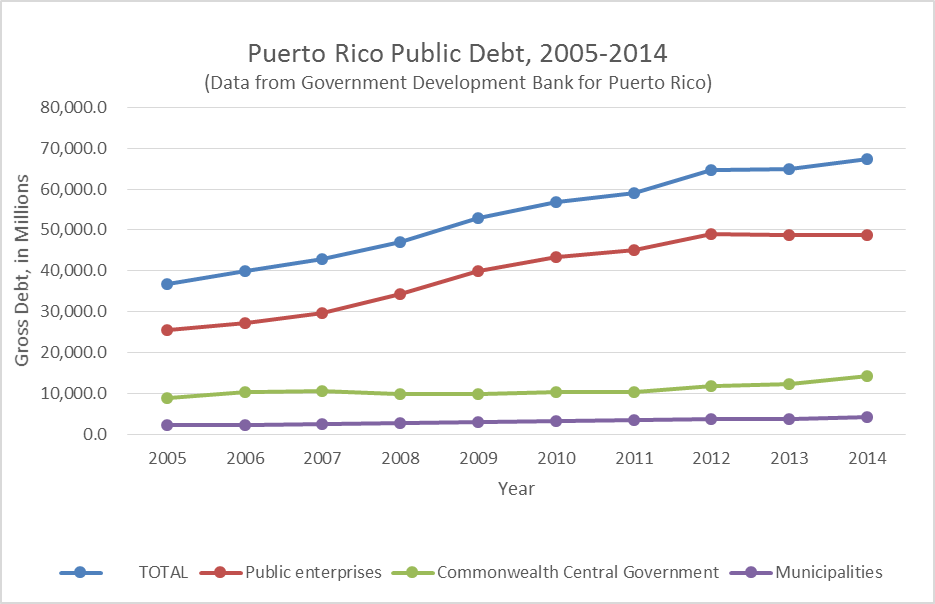

The single largest component of Puerto Rico’s total debt of approximately $72 billion belongs to the island’s inefficient utilities and other public enterprises, shown in red in the chart below.

As the central government and local municipalities have seen debt loads grow slowly from a low baseline, Puerto Rico’s public enterprises have piled up liabilities that comprise almost 70% of the territory’s debt.