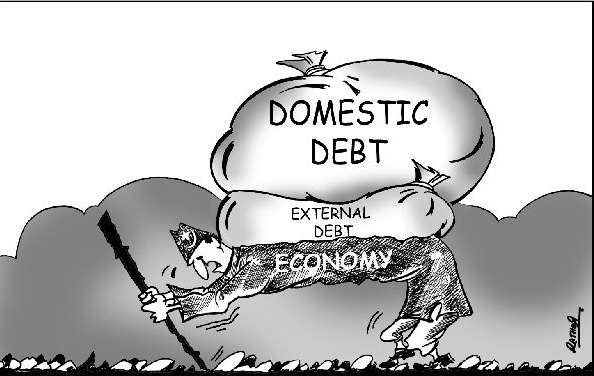

Pakistan’s current debt burden has placed their economy in a very delicate situation. The government of Pakistan has borrowed almost $950 million from banks in the past year. Pakistan is relying on it domestic debt which is adversely affecting the fiscal outlook of the country resulting in very little fiscal stability. The country’s government debt to GDP ratio is 64.30 as of December 2014. This figure is alarming because the government isn’t doing much in terms of raising tax revenues to improve the fiscal outlook.

Factors behind the debt crisis for Pakistan. Firstly, Pakistan has bee politically unstable over the past few years. The increasing debt to GDP ratio isn’t helping the stumbling nation’s cause either. This is a result of a massive decline in tax revenue over the years. Corruption has played a huge role in this aspect as only a fraction of people pay their taxes. In Pakistan, corruption occurs at the highest of levels which has a negative impact on economic growth and other business operations. Pakistan’s fiscal deficit is increasing day by day due to a major energy crisis and growing security concerns that lead to high defense spending. As a result, this causes the foreign debt to further pile up.

A developing nation such as Pakistan, where more than 60% of the people live below the poverty line cannot withstand the effects of these debts as it further worsens standard of living and well being of Pakistani citizens.

The ever rising burden of debt is one of the prime factors hampering the growth of Pakistan’s economy.