Gold reserves are viewed as being crucial to actually putting in a real value that aims to support a nation’s currency. The decline in the price of gold has gotten even worse since the end of June, but five central banks were buyers of gold in the first half of 2015.

New data released by the World Gold Council (WGC) shows central bank purchases and holdings for the month of August. Five nations that added handily to their gold reserves in the first half of 2015. These were China and Russia for the lion’s share, followed by Kazakhstan, Mongolia and Jordan. Turkey had been classified as a net-adder of gold previously due to reserves for its bank sector, but it has been decreasing net gold holdings in 2015.

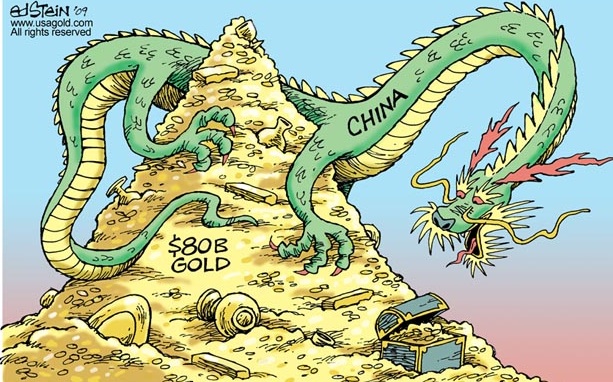

China has been trying to curb a stock market meltdown, yet China has to maintain large reserves of real assets to keep its currency up. IChina added a whopping 604 tons of gold in the month of June.

The WGC shows that China is ranked sixth in central bank holdings in the world, but that would be fifth if you remove the International Monetary Fund. China’s big move here appears to be the culmination of multiyear gold buying that had been reported but had not been tabulated.

If one nation needs to do what it can to bolster its currency, it is Russia. It has been under financial pressure since its Crimea invasion. Russia’s central bank official gold holdings were listed as being 1,275 tons. That ranks it as number 7 in the world’s gold holdings, sixth if you do not count the International Monetary Fund. Russia is a gold producer and most central bank gold acquisitions there actually take place out of that domestic market rather than on the international metals markets.

Kazakhstan has added gold in the past, and it added close to 14 more tons of gold in the first six months of 2015. The nation ranks as the 23rd largest holder of gold by central bank, but Kazakhstan would be ranked the 21st largest central bank holding gold if you account for the European Central Bank and the International Monetary Fund.

Jordan did not add to its gold holdings in the central bank in the second quarter, but the first three months of 2015 saw 14 tons added so far in 2015. The WGC did not have any special notes about what this was for, but Jordan was also shown be a net acquirer of gold during both halves of 2014.

The WGC showed that Mongolia added a mere 0.7 tons via trading activity in the month of June. Its gold had fluctuated throughout 2014, also due to trading activity. What stood out was that June was the one month of gains, with 0.7 tons added — with twice as much “out” or down in the other months combined for 2015. Again, Mongolia may be an anomaly. Still the nation wants to grow its economic clout, after three years of high growth, and Mongolia even has an exchange traded fund tracking it now.