IMF Report: “A more centralized approach would facilitate NPL resolution. The SSM [Single Supervisory Mechanism – or centralised Euro area banking authorities] is now responsible for euro area-wide supervisory policy and could take the lead in a more aggressive, top-down strategy that aims to:

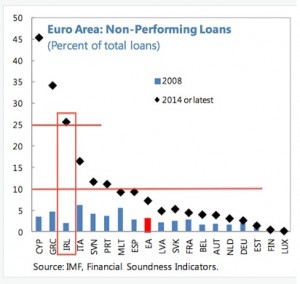

- Accelerate NPL resolution. The SSM should strengthen incentives for write-offs or debt restructuring, and coordinate with NCAs to have banks set realistic provisioning and collateral values. Higher capital surcharges or time limits on long-held NPLs would help expedite disposal. For banks with high SME NPLs, the SSM could adopt a “triage” approach by setting targets for NPL resolution and introducing standardized criteria for identifying nonviable firms for quick liquidation and viable ones for restructuring. Banks would also benefit from enhancing their NPL resolution tools and expertise.” So prepare for the national politicians and regulators walking away from any responsibility for the flood of bankruptcies to be unleashed in the poorly performing (high NPL) states, like Cyprus, Greece, Ireland, Italy, Slovenia and Portugal.

- And in order to clear the way for this national responsibility shifting to the anonymous, unaccountable central ‘authority’ of the SSM, the IMF recommends that EU states “Improve insolvency and foreclosure systems. Costly debt enforcement and foreclosure procedures complicate the disposal of impaired assets. To complement tougher supervision, insolvency reforms at the national level to accelerate court procedures and encourage out-of-court workouts would encourage market-led corporate restructuring.”

- There is another way to relieve national politicians from accountability when it comes to dealing with debt: “Jumpstart a market for distressed debt. The lack of a well-functioning market for distressed debt hinders asset disposal. Asset management companies (AMCs) at the national level could support a market for distressed debt by purchasing NPLs and disposing of them quickly. In some cases, a centralized AMC with some public sector involvement may be beneficial to provide economies of scale and facilitate debt restructuring. But such an AMC would need to comply with EU State aid rules (including, importantly, the requirement that AMCs purchase assets at market prices). In situations where markets are limited, a formula-based approach for transfer pricing should be used. European agencies, such as the EIB or EIF, could also provide support through structured finance, securitization, or equity involvement.” In basic terms, this says that we should prioritise debt sales to agencies that have weaker regulatory and consumer protection oversight than banks. Good luck getting vultures to perform cuddly nursing of the borrowers into health. NPLs