Mark Blythe writes: When the anti-austerity party Syriza came to power in Greece in January 2015, at some point, Europe was bound to face an Alexis Tsipras, the party’s leader and Greek prime minister, because there’s only so long you can ask people to vote for impoverishment today based on promises of a better tomorrow that never arrives. Despite attempts by the eurogroup, the European Central Bank, and the International Monetary Fund since February 2015 to harangue Greece into ever more austerity, the Greeks voted by an even bigger margin than they voted for Syriza to say “no” once more. So the score is now democracy 2, austerity 0.

When the euro came into existence in 1999, not only did the Greeks get to borrow like the Germans, everyone’s banks got to borrow and lend in what was effectively a cheap foreign currency. And with super-low rates, countries clamoring to get into the euro, and a continent-wide credit boom underway, it made sense for national banks to expand private lending as far as the euro could reach.

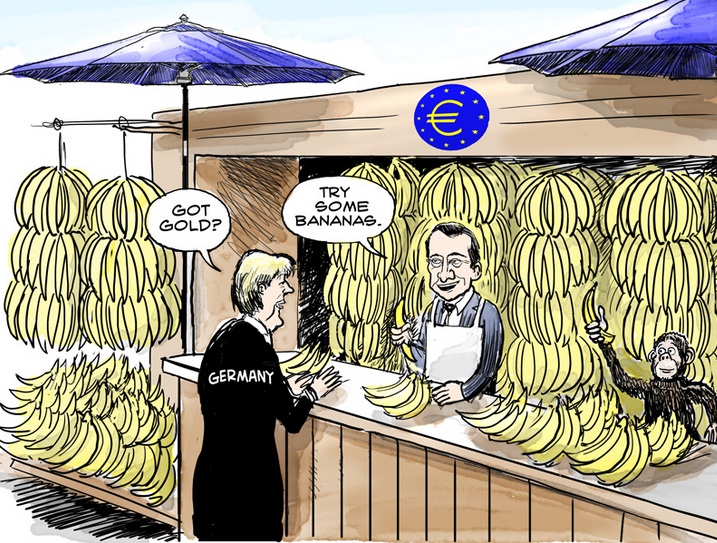

The ECB is not only violating its own statutes by limiting emergency liquidity assistance to Greek banks, but is also raising the haircuts on Greek collateral offered for new cash. In other words, the ECB, far from being an independent central bank, is acting as the eurogroup’s enforcer, despite the risk that doing so poses to the European project as a whole. We’ve never understood Greece because we have refused to see the crisis for what it was—a continuation of a series of bailouts for the financial sector that started in 2008 and that rumbles on today. It’s so much easier to blame the Greeks and then be surprised when they refuse to play along with the script. Is Greece to Blame