Mark Roe writes: A deal between Greece and its creditors might not happen. Several factors are in flux; Greek and northern European interests are not aligned; and personal animosities are in play. For Greece, an exit from the euro would not be easy, but if the alternative is endless austerity without debt forgiveness, its government may conclude that leaving the eurozone is the better choice.

Germany, for its part, would prefer to avoid a Greek exit – a position that Greek Finance Minister seems to have been banking on. But the German public largely wants to punish Greece, and German Chancellor Angela Merkel does not want to set a precedent for recurring bailouts of the European Union’s weaker members.

Failure to reach an agreement would be painful for Greece, which would face chaotic economic conditions. But an exit from the euro would also provide its government with new options – most notably, the ability devalue its currency to make its exports more competitive. For the rest of Europe, however, the risk is mostly on the downside, because beyond the obvious losses that would be incurred if Greece does not pay its debt to European governments and international institutions, there is the wider worry that the crisis could reverberate through the continent’s real economy.

There are three important risk channels through which Greece’s troubles could hit the European economy. The first is by destabilizing its financial institutions. The second is by disrupting the other EU member states in situations similar to Greece’s. And the third is by bringing about unexpected political outcomes.

It is important to recall that the 2008 financial crisis started in the United States, prosaically enough, with the bursting of a housing bubble.

The real trouble came when those losses hit the American financial system. At first, many authorities and observers thought that the crisis – beginning with the collapse of the US investment bank Lehman Brothers – could be contained.

Optimists will point out that the European institutions most exposed to the turmoil in Greece have had years to prepare themselves. And, indeed, a significant share of Greece’s government debt has migrated from banks to robust public institutions like the European Central Bank and the International Monetary Fund.

But the risks have not been eliminated. Risk and loss can spread from Greece to other heavily indebted countries, like Spain and Italy.

A Greek default and exit from the eurozone could unleash unpredictable political forces with a knock-on effect on the European economy.

Further hardship and economic turmoil could produce governments even further out on the political spectrum (the neo-fascist Golden Dawn party is another beneficiary of Greece’s economic troubles) or generate considerable instability, with governments becoming unable to provide basic security, let alone encourage an economic recovery. Add to that Greek Prime Minister Alexis Tsipras’s overtures to Russian President Vladimir Putin.

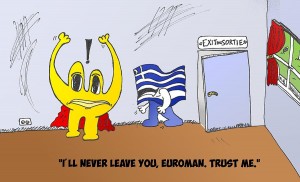

Greece has yet officially to default or leave the eurozone. There is still time for one side or the other to concede or for the various parties to find a face-saving compromise.

Many in Greece desperately want to retain the euro. As for the rest of Europe, its decision-makers may not want to risk finding out whether the repercussions of a Greek exit really can be contained.