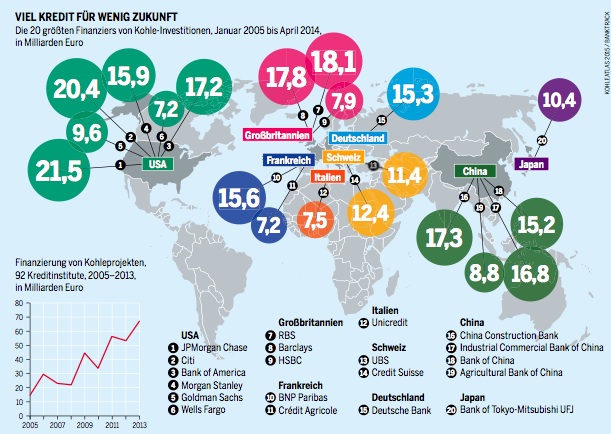

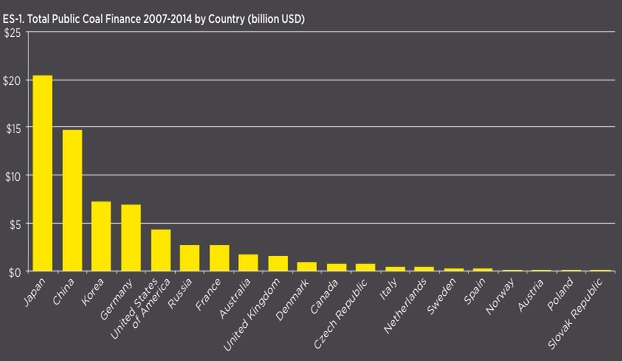

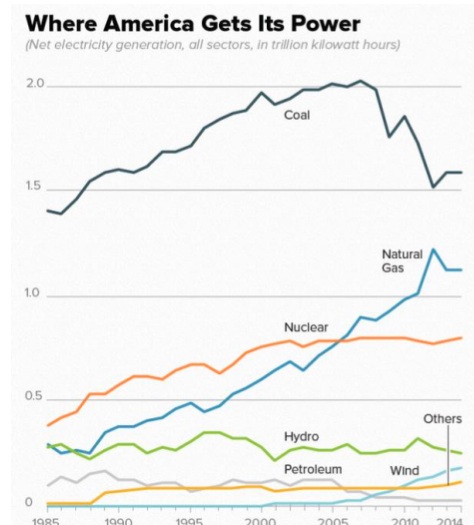

Roman Kilisek writes: The global coal industry continues to expand with new coal-fired power plants planned or being built throughout the developing world, especially in Asia where coal remains the preferred low-cost fuel option for power generation. Building up coal mining operations, constructing new coal-fired power plants and developing infrastructure requires billions of dollars in initial investments. Where countries do not have the financial wherewithal to provide energy access to their populations, global private banks and/or international financial institutions come to the rescue. Nowadays, this occurs despite persistent calls by the international community, for example, by the OECD on its member states to implement and adhere to socially responsible “green” investment standards, which would effectively strip companies of export credits for coal-related infrastructure and technology investments overseas.

While the current US administration is a staunch supporter of such measures in the name of climate protection, Japan and its companies continue to enjoy billions of dollars in annual revenues from superior coal technology exported to developing countries. Climate advocates point to coal’s significant contribution

to the accumulation of harmful carbon dioxide emissions in the atmosphere and other adverse impacts.

However, a persuasive argument can be made that exports of the developed world’s coal technology actually help lower global CO2 emissions because such technology tends to be much more efficient and in environmental terms ‘less harmful’ than indigenous plants constructed using older, less efficient designs. Air pollution in India is deemed worse than in China. “Of the world’s top 20 polluted cities, 13 are in India compared to just three in China,” the Hindustan Times reports. Investing in Coal