Stephen Greenville writes: The renminbi is still some distance from being an ‘international currency’, but it is moving fast in that direction, passing some important waypoints over recent months.

It’s not exactly clear what being an ‘international currency’ means, but one aspect is whether the currency is included in the IMF’s notional currency, the Special Drawing Rights. China is pushing strongly on this. Central bank governor Zhou Xiaochuan made the case at the recent IMF meeting. Since then capital controls have been eased further, especially for outgoing capital flows, but Governor Zhou notes the lessons of the 1997-98 Asian crisis – that completely unregulated capital flows, with their surges and ‘sudden stops’, have caused great disruption. China intends to retain enough controls to avoid these pitfalls.

In practical terms, being included in the SDR basket is no big deal, but there would be considerable prestige involved, symbolising China’s arrival at the epicentre of international transactions (the SDR currently includes just four currencies: the US dollar, the euro, the UK pound and the Japanese yen). The US is looking for more reform before the renminbi is included.

The pressure to have the renminbi included will continue when the ‘SDR basket’ comes up for its regular five-yearly reappraisal at the end of this year. The present focus is on capital account openness, but this is not the only criterion. The currency must also be ‘freely available’, which for China might mean a much deeper domestic bond market with greater foreign participation, as suggested here.

The IMF has also changed its tune on whether the renminbi is undervalued (‘manipulated’), giving China extra international competitiveness. Again, the US is resisting this assessment, with the US Treasury maintaining that the strengthening has not been ‘as fast or as much as is needed’.

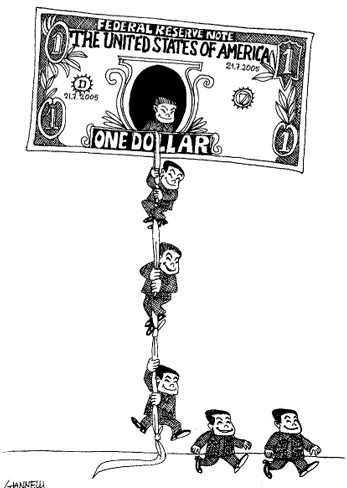

This debate, however, has lost its fervour. The Chinese current account surplus is now 2% rather than the 10% recorded in 2007; foreign exchange reserves are no longer growing; and the yuan has appreciated by 30% over the past decade. More recently it has maintained its value against an appreciating US dollar, which means it has lost competitiveness against just about everyone else.

Even one-time renminbi warrior Ted Truman (a long-serving senior official at the US Treasury and the Federal Reserve) not only accepts that the renminbi is no longer ‘manipulated’, but also that if the US pushes too dogmatically on this issue (as is being done by his colleague at the Peterson Institute, Fred Bergsten), the US might have to acknowledge that its quantitative easing policies have also had the effect of enhancing US international competitiveness.