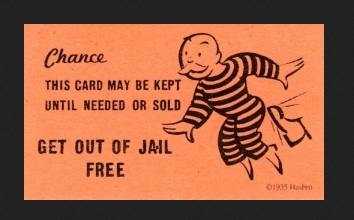

Yves Smith writes; SEC Commissioner Kara Stein has waged an uphill battle to have the agency stop giving financial firm miscreants waivers from sanctions that would otherwise take effect when they enter into settlements for bad conduct. Stein took issue with the SEC’s prior stance, that these “get out of jail” cards were issued freely to big firms by virtue of simply asking for them. The tacit assumption seemed to be that these firms were big reputable players and hence imposing the normal legally-mandated sanctions was overkill. In fact, as we know too well, the behemoth banks do disproportionate harm by their bad actions, and recent history has shown that they’ve misbehaved across a large swathe of businesses.

Despite the fact that a single SEC commissioner has limited power, Stein has managed to stymie the granting of some of these waivers by teaming up with like-minded SEC Commissioner Luis Aguilar on cases where Chairman Mary Jo White has had to recuse herself. Stein and Aguilar’s opposition to granting waivers on a recent Bank of America settlement led to further negotiations that imposed additional requirements upon the Charlotte bank. Stein and Aguilar has also been pushing for tougher punishments, including lifetime bans from SEC regulated entities for bank executives who break securities laws.

Below is Stein’s dissent on the granting of waivers to the five banks that admitted to a criminal conspiracy to rig the spot foreign exchange market in dollars and Euros. As Stein points out, the issue isn’t just the severity of this particular incident; it’s that theses firms are recidivist bad actors yet have been granted waivers on the barmy presumption that they are for the most part, corporate citizens in good standing.