John Cochrane writes in his Grumpy Economist blog: Just when you thought financial regulation couldn’t get more expansive and incoherent, our Justice Department comes in to defend morons’ right to herd. Mr. Navinder Singh Sarao is now under arrest, fighting extradition to the US, and his business ruined, for “spoofing” during the flash crash.

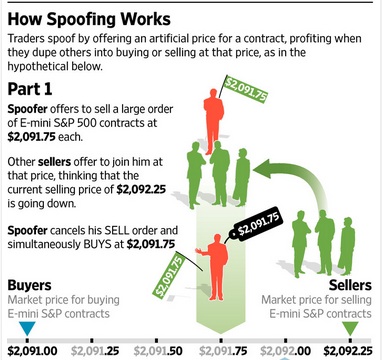

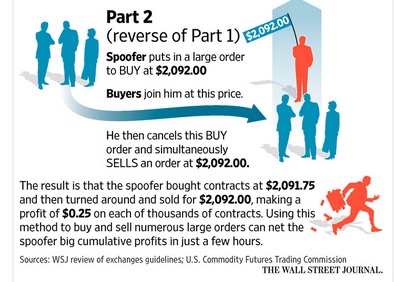

What is that? The Journal’s beautiful graph at left explains.

The obvious question: Who are these traders who respond to spoofing orders by placing their own orders? Why is it a crucial goal of law and public policy to prevent Mr. Sarao from plucking their pockets? Is “herding trader” or “momentum trader” or “badly programmed high-speed trading program” or just simple “moron in the market” now a protected minority?

Why is Mr. Sarao being prosecuted and not all the people who wrote badly programmed algorithms that were so easily spoofed? If this caused the flash crash (how, not explained in the article) are they not equally at fault?

I don’t mean by this a defense of the crazy stuff going on in high speed trading. I think one second batch auctions are a much better market structure. But the whole high speed trading thing is largely a response to SEC regulations in the first place, the order routing regulation, discrete tick size regulation, and strict time precedence regulation. A fact which will probably not enter at Mr. Sarao’s trial (he doesn’t seem to have billions for a settlement) and will give him little comfort in jail.

And maybe, just maybe, there is something more coherent here than the Journal lets on. I’ll keep reading hoping to find it and welcome comments who can.

A larger thought. We still really want to rely on regulators to spot all the problems of finance and keep us safe from more crashes?