Ben Bernanke, the former chairman of the US Federal Reserve, has joined Citadel as an adviser on monetary policy, arriving as the Chicago hedge fund recovers from a $1bn loss trading government bonds.

The ex-central banker, who stepped down from the Fed in January 2014, said he would be adding his “perspective on a range of issues affecting our global economy” in his new role.

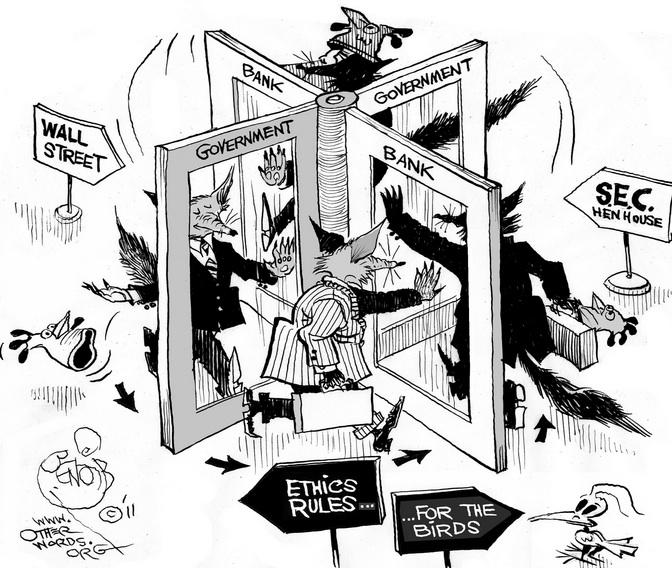

The move may fan criticism of the revolving door between the Fed and other wings of government and powerful financial firms.

Alan Greenspan, Mr Bernanke’s predecessor as Fed chairman, took up positions including acting as a consultant for Deusche Bank and hedge fund Paulson & Company after leaving the central bank.

Last month, Jeremy Stein, a former Fed governor, said he would start advising BlueMountain Capital Management, another fund.

Mr Bernanke said he was sensitive to anxieties about the “revolving door” and had chosen Citadel, rather than a position at a bank, in part because it is not regulated by the Fed. He said he would not be doing “lobbying of any sort”.

Ken Griffin, the founder and chief executive of Citadel, which has $26bn in assets under management, said Mr Bernanke has “extraordinary knowledge of the global economy and his insights on monetary policy and the capital markets will be extremely valuable to our team and to our investors.”

The appointment was announced on Thursday, hours before it emerged that Citadel’s head of fixed income, Derek Kaufman, had resigned after suffering $1bn of losses in his portfolio of developed market sovereign bonds.

People familiar with the situation said a series of macro bets went awry in 2014, dragging down the overall performance of Mr Kaufman’s 20-person team.

After a weak start to trading in 2015, he resigned two weeks ago. A former JPMorgan proprietary trader, Mr Kaufman was recruited by Citadel in 2008.

Mr Kaufman’s team was responsible for a $4bn global fixed income fund, which managed only a 0.75 per cent gain last year, and for portions of Citadel’s flagship Kensington and Wellington funds. The fixed income team will now report directly to Mr Griffin.

“Citadel is a dynamic firm with tremendously talented people and a rigorous approach to research and investing. I look forward to adding my perspective on a range of issues affecting our global economy,” said Mr Bernanke in a statement released by Citadel.

Since leaving the Fed, Mr. Bernanke’s views have been solicited by hedge fund managers and other market participants at exclusive dinners and speaking engagements. He will be a speaker at next month’s SALT conference for hedge fund managers in Las Vegas.

Mr Bernanke served as chairman of the Fed from February 2006 to January 2014, putting him at the helm of the central bank in the midst of the financial crash. Before his appointment as chairman, he chaired the president’s council of economic advisers from June 2005 to January 2006.