Is securitizing sub-prime auto loans a disaster in the making? Across the country, there is a booming business in lending to the working poor — those Americans with impaired credit who need cars to get to work. But this market is as much about Wall Street’s perpetual demand for high returns as it is about used cars. An influx of investor money is making more loans possible, but all that money may also be enabling excessive risk-taking that could have repercussions throughout the financial system, analysts and regulators caution.

In a kind of alchemy that Wall Street has previously performed with mortgages, thousands of subprime autoloans are bundled together and sold as securities to investors, including insurance companies and hedge funds. By slicing and dicing the securities, any losses if borrowers default can be contained, in theory.

Led by companies like Santander Consumer; GM Financial, and Exeter Finance, such securitizations have grown 302 percent, to $20.2 billion since 2010. And even as rising delinquencies and other signs of stress in the market emerged last year, subprime securitizations increased 28 percent from 2013. The returns are substantial in a time of low interest rates. In the case of the Santander Consumer bond offering in September, which is backed by loans on more than 84,000 vehicles, some of the highest-rated notes yield more than twice as much as certain Treasury securities.

Now questions are being raised about whether this hot Wall Street market is contributing to a broad loosening of credit standards across the subprime auto industry. Companies are increasingly enabling people at the extreme financial margins to obtain loans to buy cars.

The intense demand for subprime auto securities may also be fueling a more troubling development: a rise in loans that contain falsified income or employment information.

Ms. Payne, a former administrative assistant in the New York Police City Department, has not made a single payment on a $30,770 Santander loan that was taken out to buy a 2011 BMW 328xi. Ms. Payne, who has no driver’s license, said she took out the loan so her daughter, who lives in New Jersey, could have a car. The loan has an interest rate of 11.89 percent.

Still, some credit analysts have questioned whether the market has grown too much, too fast. Some rating firms that faced criticism after the mortgage crisis for blessing shaky investments with top ratings are taking a critical approach to subprime auto deals.

Mr. Gillock, the financial adviser in Chicago, said that no bond made up of subprime auto loans should ever receive a triple-A rating — a designation that only three blue-chip companies receive on their debt offerings.

The financial crisis provided an opportunity for subprime auto loan securitizations.

With the once-enormous market in mortgage-backed securities largely frozen, investors looked for new opportunities. One bright spot was auto lending. Even in the depths of the recession, people needed cars and were willing to pay steep rates for a loan.

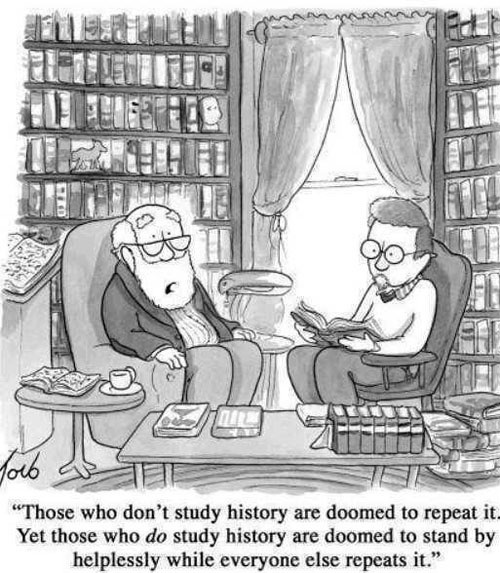

Sub-prime bundled auto loans may be the perfect example for anyone who thinks a big fine changes the culture of an investment firm. It has all the problems the subprime mortgage loans had in 2005.

.