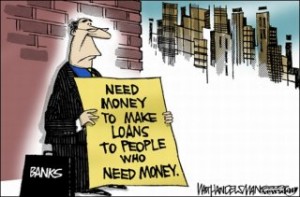

The New York Federal Reserve comments: Do riskier banks have more capital? Banking companies with more equity capital are better protected against failure because they can absorb more losses without becoming insolvent. How has the relationship between capital and risk evolved over time?

There is not question that banks’ capital policies have become more precautionary in recent years. The Federal Reserve has implemented annual supervisory stress tests which are explicitly designed to remain well-capitalized even under severe macroeconomic downturns. Improved risk management, greater awareness of downside risks and changes in supervisory practices have also had an impact. Equity capital should be the focus.

How would you feel if regulators ordered banks to hold more equity against loans to women than against loans to banks?

That is the same discrimination present when regulators order banks to hold more equity against those perceived as “risky” than against those perceived as “infallible”

Not good.