RWE has agreed to complete the sale of North Sea gasfields to a Russian billionaire — with the proviso that the German utility will buy back the UK assets in the event of sanctions against the oligarch.

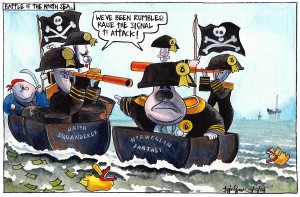

RWE’s €5bn deal to sell RWE Dea, the German group’s oil and gas arm, has been held up by opposition from the UK government following US and EU sanctions on Russia’s financial services, defence and energy sectors.

The Netherlands foundation will assume full control of Dea’s North Sea business if sanctions on Luxembourg-based L1 or its owner are imposed. Sanctions would also oblige RWE to buy back the UK business if the sanctions were imposed within one year of the deal being completed, which is due to happen in March.

RWE’s shares were up 4.5 per cent to €23.51 in Frankfurt on Friday.

L1 announced last March that it was buying Dea, which pumps oil and gas in the UK, Germany, Norway, Denmark and Egypt, for €5.1bn.

Although the deal was approved by the German government, Britain’s energy secretary Ed Davey blocked the transaction, in a sign of how private Russian companies with no connection to president Vladimir Putin were falling victim to deteriorating relations between Moscow and the west over Russia’s intervention in Ukraine.

RWE and L1 sought assurances from the UK that it would not seize control of RWE Dea’s North Sea assets if Russian companies were targeted by additional sanctions.

The deal will be carried out at almost the same price agreed last year, despite the collapse in the oil price. RWE and L1 said the value of RWE Dea had been adjusted from €5.1bn to €5bn to account for “developments relating to certain exploration and production licenses”.

The UK accounted for about one-fifth of Dea’s natural gas production in 2013, but less than two per cent of the unit’s crude oil production that year.

Mr Fridman attracted some of the most high-profile names in the energy business to advise him on his oil investments, including former British Petroleum chief executive Lord Browne.

RWE’s profits have been badly squeezed by Germany’s shift to renewables, and the company has responded by cutting operating costs and capital expenditure, and putting RWE Dea up for sale.