Since the repeal of Glass Steagall in 1999, the US government has been of the big banks, for the big banks and yes, by the big banks. Vast sums of money have been obtained by the very few. Many citizens have been hurt. More importantly, instead of helping businesses, small and large, which drive the US economy, these banks now spend most of their time on high risk derivative plays which include owning warehouses to store commodities until their price goes up and manipulating markets.

The tide is slowly turning with the alliance in the Senate of Elizabeth Warren, Sherrod Brown and Jeff Merkley.

While US regulators and the Department of Justice have been reluctant to take American-owned banks to task, propelled by the climate of the times, they have begun to go after foreign banks.

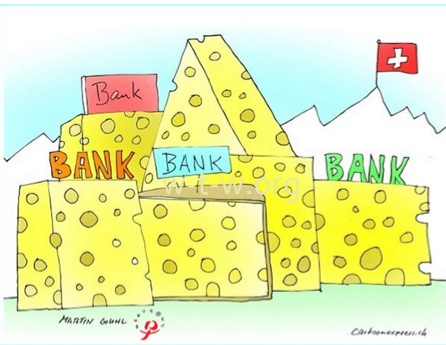

Last spring, after a dramatic session before the Senate Subcommittee on Investigations where Senators McCain and Levin let loose on the top manamagement of Swiss-based Credit Suisse, the Department of Justice followed with the announcement of a plea bargain that at last included the acceptance of a criminal charge of aiding and abetting tax evasion in addition to a large fine. Most observers had noted up until this point that banks were being fined, but the fines were ‘the cost of doing business.” Only criminal indictments would deter their behavior, it was thought.

Criminal indictments have serious consequences. Credit Suisse managed billions of dollars in pension funds in the US. Under law, a convicted felon can not manage these funds. Credit Suisse is a convicted felon. But they quickly applied for an exemption.

While it is true that the Department of Labor has regularly granted exemptions to banks over the past fifteen years, this time the route to exemption was not going to be smooth. Congresswoman Maxine Waters, and two other representatives called for a hearing.

Waters said:”Every commenter urged the DOL to enforce the law, and not grant Credit Suisse an exemption, with one exception: Credit Suisse. The Credit Suisse letter actually asks for even greater latitude in pension management. In the face of this comment record, bolstered by letters from senior members of Congress , from committees responsible for banking and pension fund oversight, it will be a miscarriage of the regulatory process if the DOL grants Credit Suisse a pass from this penalty without a hearing. Unfortunately, the DOL habitually grants such exemptions — 23 straight times in previous cases. We hope the comment record changes this streak.”

The hearing is to be held in Washington on January 15th. The question is: Will the bank lobby or the American people win? Let us hope that the DOL focuses on what Credit Suisse can do that no other bank can do. (Nothing.) Why a guilty plea to criminal activity should be over looked? How pension funds can be protected when the administrator is not governed by American law? When are we going to scratch firms from the “Too Big To Ban” list?