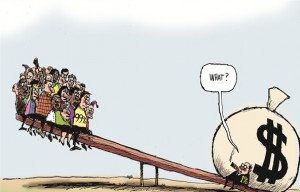

The Middle Class is disappearing in America. As study after study has shown, the US economic recovery has been a top-heavy affair, with the bulk of the wealth regained from the Great Recession benefitting the wealthiest Americans.

A report by the Pew Research Center found that the wealth gap between high income Americans and middle income Americans is now the biggest on record. “In 2013, the median wealth of the nation’s upper-income families ($639,400) was nearly seven times the median wealth of middle-income families ($96,500), the widest wealth gap seen in 30 years.

Additionally, the net worth of America’s high-income families is nearly 70 times that of lower income families.

Wealth, which Pew defines as “the difference between the value of a family’s assets (such as financial assets as well as home, car and businesses) and debts,” is different from income (the amount of money a family brings in in a given year), another measure of widening inequality that has come under scrutiny in recent years. The two are related, and wages and income have certainly stalled as the rest of the economy picks up steam.

Wealth, however, is a deeper measure of financial well-being, taking into account reserves that a family might be able to fall back on in the event emergencies, like layoffs, and live off during retirement. In the wake of the Recession, higher income families have managed to regain some or all of the wealth they’ve lost, while middle and lower income families remain behind.

That growing disparity has a lot to do with the nature of the recovery over the past six years or so. The stock market has long erased all of the losses it suffered after the 2008 crash, and the wealthiest Americans tend to have a larger proportion of their money tied up in such investments.

Middle class Americans, on the other hand, have more wealth tied up in their homes – compared to the investment sector, and the housing collapse decimated such wealth for many. In comparison to the stock market rally, the housing recovery has been relatively weak.

“Upper-income families have begun to regain some of the wealth they lost during the Great Recession, while middle-income families haven’t seen any gains,” Pew concluded.

The wealth gap may have been exacerbated by the recovery, but it was growing long before. In the 30 years since the Federal Reserve started keeping track, the richest Americans have nearly doubled their nest eggs. Middle income Americans have grown theirs by just 2.3 percent.