Mehmet Cetingulec writes: Turkey is in urgent need of investment to stem rising unemployment. It is all but obvious now that the construction sector alone cannot sustain economic growth and reduce unemployment. Investment is needed from both foreign and local sources to build plants and create jobs. Yet, economic data for the first nine months of the year shows that foreign direct investment (FDI) in Turkey is on the decline, while Turkey’s own investors are increasingly fleeing abroad.

Optimism was high earlier in the year. FDI stood at $5.1 billion in the first four months, and was estimated to reach $16 billion at year end. What happened in the second half of the year that made investors lose their appetite?

While the impact of the conflicts in Iraq, Syria and Ukraine on Turkey grew, expectations rose that emerging economies would have trouble following the US decision to stop monetary expansion. Domestically, unrest in the mainly Kurdish southeast and escalating political tensions have also discouraged foreign and local investors.

Even the revised growth target lowered from 4% to 3.3%, has become unattainable amid a downturn in investment and industrial output.

The official jobless rate, 10.1% in August, climbed to 10.5% in September. No fewer than 3,064,000 Turks are looking for work.

According to the latest data on investment, the key factor affecting unemployment, FDI inflows amounted only to $750 million in September. FDI in the first nine months of the year stood at $9.12 billion. This figure, however, includes $3.1 billion invested in real estate, which means that foreigners put only about $6 billion in business.

CHP lawmaker Umut Oran, who has conducted a comprehensive study on domestic and foreign investments, told Al-Monitor, “For years, the government managed the system with hot money. Now it is about to face the bitter reality.”

Oran argued that the Justice and Development Party (AKP) government wasted time with economic models that failed to create jobs. Turkish capital invested abroad hit an all-time high of $4.2 billion in the first nine months of the year, up 113% from the same period last year.

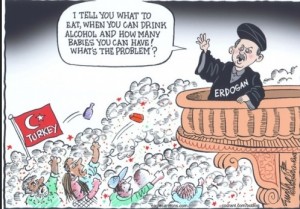

“Turkey is no longer able to lure foreign capital, as it keeps drifting away from democracy and the rule of law to being a country whose judiciary is paralyzed and public auditing mechanisms are used as a weapon by the government, and which is increasingly becoming a third-world country where one-man rule is taking root amid rampant corruption,” Oran said. “Local capital is looking for countries to flee [to]. Its new destinations are the Netherlands, Germany, Azerbaijan and the United States.”

Faik Oztrak, CHP deputy chairman for relations with the business community and a former Treasury undersecretary, told Al-Monitor he had obtained more recent figures, which indicate that FDI in the first 10 months of the year amounted to $10 billion, while Turkish investment abroad reached $4.7 billion in the same period.

“Our businesspeople seem to believe that the investment climate in Turkey has deteriorated. And they have good reasons for that. To expect them to make investments in a country where the rule of law takes blows each and every day, where the concept of justice is eroding and political interference in the economy is increasing, would be over-optimistic,” Oztak said.

Oztrak’s point is of critical importance. The Turkish economy faces an uphill track, even though it benefits from falling oil prices. Before anything else, Turkey has to guarantee law and justice, stamp out nepotism and make sure to address people’s fears.