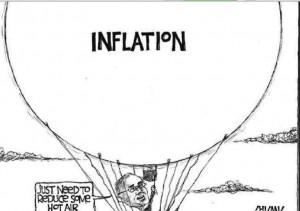

Mehmet Cetingulec writes: Turkey’s Central Bank, whose resistance to government pressure to lower interest rates proved to be the right decision, has not had the same success in ensuring financial stability by controlling inflation.

The Central Bank’s record against inflation has been dismal not only this year, but for several years.Since Erdem Besci was appointed its governor in 2011, none of the bank’s inflation aims have been achieved.

In 2011, annual inflation was predicted to be 5.5% but ended up at 10.4%. In 2012, the bank’s inflation target was 5%, but it ended up 6.16%. The 2013 target was 5% but the result was 7.4%. The 2014 target was set at 5.3%, then adjusted upward to 6.6%. But it’s now clear that even that target won’t be hit.

Turkey’s Central Bank has two basic duties: keeping inflation under control and ensuring stability in financial markets. In 1997, the bank and the Treasury signed an agreement to cooperate to lower inflation rates. The idea was to lower inflation by adopting monetary and financial measures in cooperation with relevant public agencies. Though this protocol is valid, inflation still cannot be lowered.

The Central Bank had forecast improvement in inflation after June 2014. Basci, under heavy pressure, had promised lower inflation and interest rates in a June 2 presentation to the council of ministers. On June 3, Prime Minister Recep Tayyip Erdogan, who was unhappy with Basci, said “The Central Bank said it will lower interest rates… I don’t find their approach to interest rates worthwhile.”

What the prime minister had meant to say was explained by pro-government Sabah, which reported that the governor was given a three-month grace period.

But months have passed and the anticipated reduction in inflation and therefore in interest rates did not materialize. When the trend continued unabated, the 5.3% inflation rate was pushed up to 9.5%. By naming this new target in its medium-term program, the government has acknowledged in advance that the inflation rate will double by the end of the year.

Meanwhile, the IMF revised its prediction for Turkey’s inflation upward to 9% from 7.8%. Inflation did not go down and the interest rate was not reduced, but the alternative plan that was to be applied after the three-month grace period was not introduced.

Prime Minister Erdogan, who was targeting Basci, has since been elected president. Prime Minister Ahmet Davutoglu, who formed the new government, does not have the luxury of making controversial decisions by changing the economic management when the regional developments signal increased risks.

Babacan and his economic management team stipulated the lowering of inflation as the primary target of its 2015-17 program, whereas earlier, the primary target was to lower the current deficit. That target has been achieved to some extent. The current deficit, which was above $60 billion at the end of last year, is now below $50 billion. The goal will be now to achieve the same success in lowering inflation. But it is not possible. Neither Babacan nor Basci have enough time to leave behind a legacy of success.